Are you considering taking out a business loan to help your company grow but aren’t sure if it’s the right choice? Applying for a business loan can be intimidating, but doing so has multiple advantages. Many business owners are now tapping into different financing options to fund their business operations. However, many said that private loans for business are one of the most popular options. Here, we will talk about the advantages of applying for a business loan.

Reasonable Interest Rates

One of the advantages of taking out a business loan is that you can find competitive interest rates. Traditional banking institutions are often willing to work with businesses to provide reasonable interest rates, as they want to keep their customers satisfied. Another great benefit of taking out a business loan is that most lenders will allow you to choose both fixed and variable-rate loans. With a fixed-rate loan, you can ensure that the interest rate will stay the same throughout the loan term. On the other hand, a variable-rate loan will fluctuate according to market conditions. According to people who took business loans, variable-rate loans are often more attractive for small businesses since the interest rate is lower, and the loan can be paid back faster.

One of the advantages of taking out a business loan is that you can find competitive interest rates. Traditional banking institutions are often willing to work with businesses to provide reasonable interest rates, as they want to keep their customers satisfied. Another great benefit of taking out a business loan is that most lenders will allow you to choose both fixed and variable-rate loans. With a fixed-rate loan, you can ensure that the interest rate will stay the same throughout the loan term. On the other hand, a variable-rate loan will fluctuate according to market conditions. According to people who took business loans, variable-rate loans are often more attractive for small businesses since the interest rate is lower, and the loan can be paid back faster.

Access to Larger Amounts of Money

Another advantage of taking out a business loan is that you can access larger amounts of money than what your company could typically cover. For example, if you are about to launch a new product line, you may need a large sum of money that your company doesn’t have available. Taking out a business loan will allow you to access the capital you need to help get your business off the ground. Other loans like credit cards limit how much money you can borrow, but business loans allow you to borrow more at a reasonable interest rate. You should consider this if you need additional capital to grow your business.

Amazing Tax Benefits

The last advantage of taking out a business loan is that you can often benefit from amazing tax benefits. Many lenders will allow you to deduct interest payments from your taxable income, which means that you can save a lot of money over time. Also, depending on where you live, some states may offer additional tax deductions for businesses that take out loans. Business owners should always consult with a tax professional to make sure that they are taking advantage of all the available tax benefits. Some people do not know that they can get amazing tax benefits from a business loan, so it is important to consult with the right professionals.

The last advantage of taking out a business loan is that you can often benefit from amazing tax benefits. Many lenders will allow you to deduct interest payments from your taxable income, which means that you can save a lot of money over time. Also, depending on where you live, some states may offer additional tax deductions for businesses that take out loans. Business owners should always consult with a tax professional to make sure that they are taking advantage of all the available tax benefits. Some people do not know that they can get amazing tax benefits from a business loan, so it is important to consult with the right professionals.

Overall, there are many advantages of applying for a business loan. Not only can you access larger amounts of money for your company, but you can also benefit from reasonable interest rates and amazing tax benefits. It is important to do your research and speak to the right professionals before taking out a business loan. With a good lender’s help, you can ensure that your company will have access to the capital it needs for growth and success.

Finding a reputable hard money lender can be difficult, but it’s worth the effort to ensure that you’re dealing with a legitimate business. Start by doing your research – read reviews from other borrowers and determine which lenders have a good reputation in the industry. Once you’ve narrowed down your choices, ask for references from each lender and call them to assess their services honestly.

Finding a reputable hard money lender can be difficult, but it’s worth the effort to ensure that you’re dealing with a legitimate business. Start by doing your research – read reviews from other borrowers and determine which lenders have a good reputation in the industry. Once you’ve narrowed down your choices, ask for references from each lender and call them to assess their services honestly.

Mortgage rates and terms can vary greatly depending on the lender, so it’s essential to do your research before committing. The interest rate is just one factor in your mortgage loan, so make sure you also consider the term of the loan, origination fees, and other associated costs. Various mortgage loan products are available, each with its own set of benefits and drawbacks.

Mortgage rates and terms can vary greatly depending on the lender, so it’s essential to do your research before committing. The interest rate is just one factor in your mortgage loan, so make sure you also consider the term of the loan, origination fees, and other associated costs. Various mortgage loan products are available, each with its own set of benefits and drawbacks. When you are ready to apply for a mortgage loan, you will need to provide information about your income, assets, and debts. The lender will use this information to calculate your debt-to-income ratio. This is a measure of how much debt you have compared to your income. The higher your debt-to-income ratio, the more risk you pose to the lender. This is because a high debt-to-income ratio means you may be unable to make your monthly mortgage payments if interest rates rise or your income falls.

When you are ready to apply for a mortgage loan, you will need to provide information about your income, assets, and debts. The lender will use this information to calculate your debt-to-income ratio. This is a measure of how much debt you have compared to your income. The higher your debt-to-income ratio, the more risk you pose to the lender. This is because a high debt-to-income ratio means you may be unable to make your monthly mortgage payments if interest rates rise or your income falls.

When these loans are not paid off due, many borrowers find themselves in financial problems. More fees are added to the loan each time the borrower extends it. According to the Consumer Financial Protection Bureau, payday lenders levy $10 to $30 for every $100 borrowed. The annual return on a $15 fee is almost 400 percent. Payday loans are available to people with bad credit and do not usually require a credit check. Payday loans are used by around 12 million Americans each year, most of whom do not have access to a credit card or a savings account.

When these loans are not paid off due, many borrowers find themselves in financial problems. More fees are added to the loan each time the borrower extends it. According to the Consumer Financial Protection Bureau, payday lenders levy $10 to $30 for every $100 borrowed. The annual return on a $15 fee is almost 400 percent. Payday loans are available to people with bad credit and do not usually require a credit check. Payday loans are used by around 12 million Americans each year, most of whom do not have access to a credit card or a savings account. Even though most states have laws governing payday loan amounts, the amount that qualifies for a loan varies depending on the borrower’s income and the payday lender. Several states even prohibit borrowers from having multiple outstanding payday loans to discourage people from borrowing large sums of money at high-interest rates. Loan amounts might range from $70 to $1,500, depending on state law.

Even though most states have laws governing payday loan amounts, the amount that qualifies for a loan varies depending on the borrower’s income and the payday lender. Several states even prohibit borrowers from having multiple outstanding payday loans to discourage people from borrowing large sums of money at high-interest rates. Loan amounts might range from $70 to $1,500, depending on state law.

Maybe you are planning on going for a trip to a holiday destination, and everything gets in place. However, you need to sort out the numerous expenses. Fortunately, with online loans, you can now access personal loans without a lot of paperwork. Also, you do not have to make trips to the bank. Thus, with a quick money loan, you can plan a trip to the destination of your choice. It does not matter whether it is a local popular tourist destination or a foreign trip; you can meet your expenses.

Maybe you are planning on going for a trip to a holiday destination, and everything gets in place. However, you need to sort out the numerous expenses. Fortunately, with online loans, you can now access personal loans without a lot of paperwork. Also, you do not have to make trips to the bank. Thus, with a quick money loan, you can plan a trip to the destination of your choice. It does not matter whether it is a local popular tourist destination or a foreign trip; you can meet your expenses.

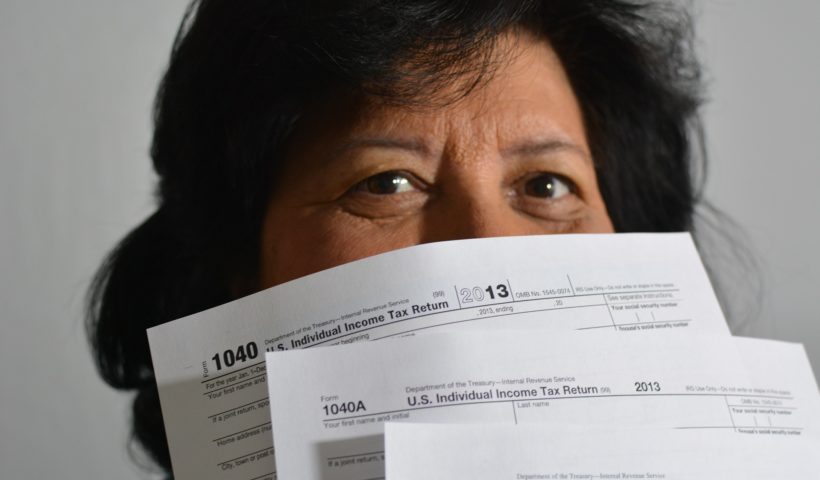

The first thing to do is filing the returns on time to ensure your file with the revenue authority is in order and to lower chances of paying penalties. Keeping your tax return profile in check is important. The nature of your financial statements affects the type of tax returns to fill, and individuals may not have many complications since you only need to declare incomes and highlight what employers are remitting. Much of the information will be available on your system’s profile. However, those seeking refunds usually have additional details to offer to declare expenses and other conditions for a refund. Starting the process early eases your prospects of qualifying for refunds with the present financial year.

The first thing to do is filing the returns on time to ensure your file with the revenue authority is in order and to lower chances of paying penalties. Keeping your tax return profile in check is important. The nature of your financial statements affects the type of tax returns to fill, and individuals may not have many complications since you only need to declare incomes and highlight what employers are remitting. Much of the information will be available on your system’s profile. However, those seeking refunds usually have additional details to offer to declare expenses and other conditions for a refund. Starting the process early eases your prospects of qualifying for refunds with the present financial year.