Your 20s may feel like a time for exploration, but they also define your financial future. The habits you form now can influence how secure and free you feel decades from today. This stage of life is about building foundations. Every choice, from saving to spending, plays a role. By focusing on smart practices, you give yourself a stronger chance at lasting wealth.

The Importance of Emergency Funds

Unexpected events are part of life. A car repair, a medical bill, or a sudden job loss can happen without warning. An emergency fund acts as a safety net. Aim to save enough to cover a few months of living costs. Even small contributions grow over time if you remain consistent. This fund ensures that challenges do not push you into debt. It also brings peace of mind during uncertain times.

Budgeting With Intention

A budget is more than numbers on a page. It is a map that guides how you handle income and expenses. Tracking where money goes ensures you avoid careless spending. It also highlights areas where adjustments are needed. Setting clear categories for needs, wants, and savings makes managing funds simpler. With practice, budgeting becomes less restrictive and more empowering.

Saving Early for Retirement

Retirement feels distant in your 20s, but saving early offers unique advantages. Compounding allows money to grow faster the longer it stays invested. Even modest monthly contributions can build substantial wealth over decades. Employer-sponsored plans and personal retirement accounts make the process easier. Starting now ensures you take full advantage of time, which is your utmost asset.

Building and Protecting Credit

Credit is more than a number. It affects your ability to rent, buy a home, or secure loans. Building good credit in your 20s sets the tone for financial opportunities later. Paying bills on time and keeping balances low are key habits. Avoid unnecessary debt, but use credit responsibly to establish a history. Strong credit ensures flexibility when larger financial goals arise.

Investing for Growth

Investing is a path to wealth that saving alone cannot achieve. Stocks, bonds, and funds provide growth opportunities. Begin with simple, diversified options to limit risk. Consistency is more important than timing the market. Every investment is a step toward building long-term security. With patience, the money you put away now can multiply significantly over the years.

Controlling Lifestyle Inflation

As income rises, it is tempting to upgrade everything. A bigger apartment, a nicer car, or frequent dining out can quickly consume extra earnings. This is known as lifestyle inflation. Controlling it ensures that higher income leads to stronger savings, not larger expenses. Allow yourself enjoyment, but balance it with discipline. The goal is to live well while still planning ahead.

Wealth is not built overnight. It requires discipline, patience, and clarity about future goals. Think about where you want to be in ten or twenty years. Use that vision to guide daily financial choices. Whether it is owning a home, traveling, or retiring early, your habits today shape those outcomes. By maintaining perspective, you ensure every action supports a larger purpose.

Starting a budget in your 20s can feel like a chore, but it’s one of the best gifts you can give yourself. It’s about knowing where your money goes and making it work for you. Begin by tracking your income and expenses. This simple step will help identify spending patterns. You might be surprised at how much those daily coffee runs add up! Once you’ve gathered that information, set clear goals. Whether saving for travel or paying off debt, having specific targets keeps you motivated. Adjusting as needed is key, too—your needs will change over time, so flexibility is essential.

Starting a budget in your 20s can feel like a chore, but it’s one of the best gifts you can give yourself. It’s about knowing where your money goes and making it work for you. Begin by tracking your income and expenses. This simple step will help identify spending patterns. You might be surprised at how much those daily coffee runs add up! Once you’ve gathered that information, set clear goals. Whether saving for travel or paying off debt, having specific targets keeps you motivated. Adjusting as needed is key, too—your needs will change over time, so flexibility is essential.

When transitioning to retirement as a single individual, it’s crucial to reassess your budget and make any necessary adjustments. This step will help you maintain financial stability and ensure that your golden years are filled with comfort and peace of mind. Start by evaluating your current income sources, including retirement savings, Social Security benefits, or any other streams of revenue. Determine how much money is coming in each month and compare it to your expenses. Take note of where you may be overspending or areas where you can cut back without sacrificing too much.

When transitioning to retirement as a single individual, it’s crucial to reassess your budget and make any necessary adjustments. This step will help you maintain financial stability and ensure that your golden years are filled with comfort and peace of mind. Start by evaluating your current income sources, including retirement savings, Social Security benefits, or any other streams of revenue. Determine how much money is coming in each month and compare it to your expenses. Take note of where you may be overspending or areas where you can cut back without sacrificing too much. As you approach your golden years, it becomes even more important to ensure that you have a solid plan in place. However, navigating the complexities of retirement planning can be overwhelming on your own. That’s why connecting with financial experts can greatly benefit single individuals looking to thrive in their golden years. These professionals are well-versed in the intricacies of retirement planning and can provide invaluable guidance tailored specifically to your unique needs and goals. Financial experts have extensive knowledge and experience in areas such as investments, taxes, insurance policies, and long-term care options. They can help identify potential risks or gaps in your current financial strategy and offer recommendations on how best to mitigate them.

As you approach your golden years, it becomes even more important to ensure that you have a solid plan in place. However, navigating the complexities of retirement planning can be overwhelming on your own. That’s why connecting with financial experts can greatly benefit single individuals looking to thrive in their golden years. These professionals are well-versed in the intricacies of retirement planning and can provide invaluable guidance tailored specifically to your unique needs and goals. Financial experts have extensive knowledge and experience in areas such as investments, taxes, insurance policies, and long-term care options. They can help identify potential risks or gaps in your current financial strategy and offer recommendations on how best to mitigate them.

Health insurance is one of the most important coverage types everyone should consider. It helps pay for medical expenses, including doctor visits, hospital stays, prescription medications, etc. Without health insurance, you could face significant out-of-pocket costs that can quickly add up and cause financial hardship. If you are still on the fence about getting health insurance, you should first learn more about health care from top doctors like dr.daniel lumian. Before selecting a plan, it’s essential to review the details outlined in the policy documents carefully. This will help ensure you understand how your coverage works and what services are covered under your specific plan.

Health insurance is one of the most important coverage types everyone should consider. It helps pay for medical expenses, including doctor visits, hospital stays, prescription medications, etc. Without health insurance, you could face significant out-of-pocket costs that can quickly add up and cause financial hardship. If you are still on the fence about getting health insurance, you should first learn more about health care from top doctors like dr.daniel lumian. Before selecting a plan, it’s essential to review the details outlined in the policy documents carefully. This will help ensure you understand how your coverage works and what services are covered under your specific plan.

Car insurance is a must for anyone who owns and operates a vehicle. Accidents happen, and car insurance can help protect you financially in an accident or theft. There are several types of car insurance coverage available, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, and personal injury protection. In most states, liability coverage is required by law and covers damages that you may cause to other people or their property while driving your car. Collision coverage will cover damages to your own vehicle if you are at fault in an accident. Comprehensive coverage protects against non-collision events such as theft or damage from natural disasters like floods or hailstorms.

Car insurance is a must for anyone who owns and operates a vehicle. Accidents happen, and car insurance can help protect you financially in an accident or theft. There are several types of car insurance coverage available, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, and personal injury protection. In most states, liability coverage is required by law and covers damages that you may cause to other people or their property while driving your car. Collision coverage will cover damages to your own vehicle if you are at fault in an accident. Comprehensive coverage protects against non-collision events such as theft or damage from natural disasters like floods or hailstorms.

When about to borrow money, the APR should never be overlooked. This is because the APR represents the true cost of borrowing that includes both interest and any additional fees associated with a loan. For medical loans, it pays to compare APRs from various different lenders to get the best deal. A lower APR means you’ll pay less in interest charges over time, which can save you significant amounts of money. It’s worth noting that your credit score will also affect your APR – generally speaking, borrowers with higher credit scores are offered better rates than those with poor or fair credit.

When about to borrow money, the APR should never be overlooked. This is because the APR represents the true cost of borrowing that includes both interest and any additional fees associated with a loan. For medical loans, it pays to compare APRs from various different lenders to get the best deal. A lower APR means you’ll pay less in interest charges over time, which can save you significant amounts of money. It’s worth noting that your credit score will also affect your APR – generally speaking, borrowers with higher credit scores are offered better rates than those with poor or fair credit. When considering medical loans, don’t forget to take into account the origination fee. This fee is a one-time fee charged by lenders for processing and initiating the loan, ranging from 1% to 8% of the total. At first, it’s only like an extra expense, but note that various lenders may offer much lower rates but with a higher origination fee. So check if the lender charges any prepayment penalties or other hidden fees that could increase your overall expenses. Don’t hesitate to ask questions about these fees before signing up for a medical loan. Finding the best medical loan for your needs requires careful consideration of the abovementioned factors.

When considering medical loans, don’t forget to take into account the origination fee. This fee is a one-time fee charged by lenders for processing and initiating the loan, ranging from 1% to 8% of the total. At first, it’s only like an extra expense, but note that various lenders may offer much lower rates but with a higher origination fee. So check if the lender charges any prepayment penalties or other hidden fees that could increase your overall expenses. Don’t hesitate to ask questions about these fees before signing up for a medical loan. Finding the best medical loan for your needs requires careful consideration of the abovementioned factors.

One of the advantages of taking out a business loan is that you can find competitive interest rates. Traditional banking institutions are often willing to work with businesses to provide reasonable interest rates, as they want to keep their customers satisfied. Another great benefit of taking out a business loan is that most lenders will allow you to choose both fixed and variable-rate loans. With a fixed-rate loan, you can ensure that the interest rate will stay the same throughout the loan term. On the other hand, a variable-rate loan will fluctuate according to market conditions. According to people who took business loans, variable-rate loans are often more attractive for small businesses since the interest rate is lower, and the loan can be paid back faster.

One of the advantages of taking out a business loan is that you can find competitive interest rates. Traditional banking institutions are often willing to work with businesses to provide reasonable interest rates, as they want to keep their customers satisfied. Another great benefit of taking out a business loan is that most lenders will allow you to choose both fixed and variable-rate loans. With a fixed-rate loan, you can ensure that the interest rate will stay the same throughout the loan term. On the other hand, a variable-rate loan will fluctuate according to market conditions. According to people who took business loans, variable-rate loans are often more attractive for small businesses since the interest rate is lower, and the loan can be paid back faster.

The last advantage of taking out a business loan is that you can often benefit from amazing tax benefits. Many lenders will allow you to deduct interest payments from your taxable income, which means that you can save a lot of money over time. Also, depending on where you live, some states may offer additional tax deductions for businesses that take out loans. Business owners should always consult with a tax professional to make sure that they are taking advantage of all the available tax benefits. Some people do not know that they can get amazing tax benefits from a business loan, so it is important to consult with the right professionals.

The last advantage of taking out a business loan is that you can often benefit from amazing tax benefits. Many lenders will allow you to deduct interest payments from your taxable income, which means that you can save a lot of money over time. Also, depending on where you live, some states may offer additional tax deductions for businesses that take out loans. Business owners should always consult with a tax professional to make sure that they are taking advantage of all the available tax benefits. Some people do not know that they can get amazing tax benefits from a business loan, so it is important to consult with the right professionals.

Finding a reputable hard money lender can be difficult, but it’s worth the effort to ensure that you’re dealing with a legitimate business. Start by doing your research – read reviews from other borrowers and determine which lenders have a good reputation in the industry. Once you’ve narrowed down your choices, ask for references from each lender and call them to assess their services honestly.

Finding a reputable hard money lender can be difficult, but it’s worth the effort to ensure that you’re dealing with a legitimate business. Start by doing your research – read reviews from other borrowers and determine which lenders have a good reputation in the industry. Once you’ve narrowed down your choices, ask for references from each lender and call them to assess their services honestly.

If you’re really trying to stretch your

If you’re really trying to stretch your  Finally, it is important to plan ahead when trying to stretch your budget. Think of ways to save on big expenses like holiday gifts or vacations. You can also start setting aside money each month to prepare for unexpected costs or emergencies. Additionally, make sure you are tracking your expenses and setting financial goals so that you can stay on top of your budget.

Finally, it is important to plan ahead when trying to stretch your budget. Think of ways to save on big expenses like holiday gifts or vacations. You can also start setting aside money each month to prepare for unexpected costs or emergencies. Additionally, make sure you are tracking your expenses and setting financial goals so that you can stay on top of your budget.

Before making any investment, it’s important to do your research and understand the risks involved. Precious metals are no exception. The price of gold and silver can fluctuate dramatically over short periods, so it is important to research current market trends and be prepared for the possibility of significant losses. Also, many governments impose taxes on gold and silver investments, so it is essential to familiarize yourself with these regulations before investing.

Before making any investment, it’s important to do your research and understand the risks involved. Precious metals are no exception. The price of gold and silver can fluctuate dramatically over short periods, so it is important to research current market trends and be prepared for the possibility of significant losses. Also, many governments impose taxes on gold and silver investments, so it is essential to familiarize yourself with these regulations before investing.

Like most people, you have your savings account at a bank or credit union. These financial institutions typically offer very low-interest rates on savings accounts. The average savings account interest rate is just 0.06%. That means for every $100 you have in your account; you’ll earn just $0.06 in interest over a year. The stock market has historically provided much higher returns than savings accounts. Over the last 100 years, the stock market has averaged an annual return of approximately 10%. This means your investments in the stock market have the potential to grow 10 times faster than your savings account.

Like most people, you have your savings account at a bank or credit union. These financial institutions typically offer very low-interest rates on savings accounts. The average savings account interest rate is just 0.06%. That means for every $100 you have in your account; you’ll earn just $0.06 in interest over a year. The stock market has historically provided much higher returns than savings accounts. Over the last 100 years, the stock market has averaged an annual return of approximately 10%. This means your investments in the stock market have the potential to grow 10 times faster than your savings account.

Bitcoin is the world’s most popular cryptocurrency, and it is also one of the most valuable. Bitcoin is worth investing in for a variety of reasons. First, it is very liquid, meaning it can easily be bought and sold. Second, it has a large market capitalization, which means that there is a lot of demand for it.

Bitcoin is the world’s most popular cryptocurrency, and it is also one of the most valuable. Bitcoin is worth investing in for a variety of reasons. First, it is very liquid, meaning it can easily be bought and sold. Second, it has a large market capitalization, which means that there is a lot of demand for it. In September, Litecoin underwent a halving, which cut the block

In September, Litecoin underwent a halving, which cut the block

Businesses use stubs to track inventory for several reasons. First, it helps them keep track of what products they have in stock. Second, it allows businesses to see how much product they’ve sold over some time. This information is vital for managing inventory levels and ensuring that customers always have the products they need.

Businesses use stubs to track inventory for several reasons. First, it helps them keep track of what products they have in stock. Second, it allows businesses to see how much product they’ve sold over some time. This information is vital for managing inventory levels and ensuring that customers always have the products they need. Another common reason businesses use stubs is to increase efficiency. By automating the process of creating and distributing stubs, companies can save time and money. In addition, by using stubs, businesses can avoid errors that can occur when manually creating and distributing pay stubs.

Another common reason businesses use stubs is to increase efficiency. By automating the process of creating and distributing stubs, companies can save time and money. In addition, by using stubs, businesses can avoid errors that can occur when manually creating and distributing pay stubs.

Did you know that there are loans that approve the same day you applied for them? Yes, 1 hour payday loans are not just some godsent myth designed to help people in dire situations – they’re real, and they can be a lifesaver when you need quick cash. Simply fill out an application online or at a storefront lender to get a payday

Did you know that there are loans that approve the same day you applied for them? Yes, 1 hour payday loans are not just some godsent myth designed to help people in dire situations – they’re real, and they can be a lifesaver when you need quick cash. Simply fill out an application online or at a storefront lender to get a payday  Another great way to

Another great way to

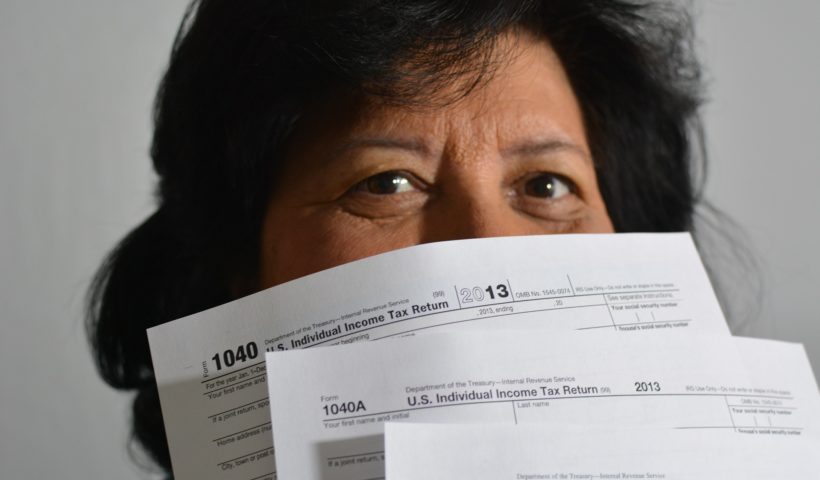

Before choosing a personal loan against an income tax return, do your research to learn about all lenders that offer this type of financing. You’ll want to compare interest rates and fees as well as any other terms or conditions they may have attached with their loans. This will help ensure that you find the best lender for your needs. When looking for a personal loan against an income tax return, it’s essential to find a reputable lender with a good reputation. You don’t want to deal with any surprises down the road, so be sure to read reviews from past customers before making your final decision.

Before choosing a personal loan against an income tax return, do your research to learn about all lenders that offer this type of financing. You’ll want to compare interest rates and fees as well as any other terms or conditions they may have attached with their loans. This will help ensure that you find the best lender for your needs. When looking for a personal loan against an income tax return, it’s essential to find a reputable lender with a good reputation. You don’t want to deal with any surprises down the road, so be sure to read reviews from past customers before making your final decision.

Before you take a loan, it is crucial to understand the different types of available loans. There are three main types of loans: secured loans, unsecured loans, and personal loans. A secured loan is one where you offer an asset as collateral. This type of loan typically has a lower interest rate than an unsecured loan. An unsecured loan is a loan that does not require any collateral. This type of loan typically has higher interest rates than secured loans.

Before you take a loan, it is crucial to understand the different types of available loans. There are three main types of loans: secured loans, unsecured loans, and personal loans. A secured loan is one where you offer an asset as collateral. This type of loan typically has a lower interest rate than an unsecured loan. An unsecured loan is a loan that does not require any collateral. This type of loan typically has higher interest rates than secured loans. Some crucial considerations must be made before signing any paperwork for a loan agreement. You should consider the interest rates, the repayment terms, and what will happen if you can’t make your payments. You’ll also want to be sure that you’re borrowing from a reputable lender. Check online reviews and compare interest rates before making any decisions. And remember, it’s always best to consult with an attorney or financial advisor before signing anything.

Some crucial considerations must be made before signing any paperwork for a loan agreement. You should consider the interest rates, the repayment terms, and what will happen if you can’t make your payments. You’ll also want to be sure that you’re borrowing from a reputable lender. Check online reviews and compare interest rates before making any decisions. And remember, it’s always best to consult with an attorney or financial advisor before signing anything.

when taking out a tax advance loan, it’s essential to understand precisely how they work. These loans are very similar to any other type of loan that you would get from your bank or credit union – except instead of using collateral (such as property), you’re using your tax refund as security for the amount borrowed. The lender will give you an estimate on what they think your tax refund will be, and then you’ll sign an agreement with them stating if the forecast is correct or less than expected.

when taking out a tax advance loan, it’s essential to understand precisely how they work. These loans are very similar to any other type of loan that you would get from your bank or credit union – except instead of using collateral (such as property), you’re using your tax refund as security for the amount borrowed. The lender will give you an estimate on what they think your tax refund will be, and then you’ll sign an agreement with them stating if the forecast is correct or less than expected.

Mortgage rates and terms can vary greatly depending on the lender, so it’s essential to do your research before committing. The interest rate is just one factor in your mortgage loan, so make sure you also consider the term of the loan, origination fees, and other associated costs. Various mortgage loan products are available, each with its own set of benefits and drawbacks.

Mortgage rates and terms can vary greatly depending on the lender, so it’s essential to do your research before committing. The interest rate is just one factor in your mortgage loan, so make sure you also consider the term of the loan, origination fees, and other associated costs. Various mortgage loan products are available, each with its own set of benefits and drawbacks. When you are ready to apply for a mortgage loan, you will need to provide information about your income, assets, and debts. The lender will use this information to calculate your debt-to-income ratio. This is a measure of how much debt you have compared to your income. The higher your debt-to-income ratio, the more risk you pose to the lender. This is because a high debt-to-income ratio means you may be unable to make your monthly mortgage payments if interest rates rise or your income falls.

When you are ready to apply for a mortgage loan, you will need to provide information about your income, assets, and debts. The lender will use this information to calculate your debt-to-income ratio. This is a measure of how much debt you have compared to your income. The higher your debt-to-income ratio, the more risk you pose to the lender. This is because a high debt-to-income ratio means you may be unable to make your monthly mortgage payments if interest rates rise or your income falls.

When these loans are not paid off due, many borrowers find themselves in financial problems. More fees are added to the loan each time the borrower extends it. According to the Consumer Financial Protection Bureau, payday lenders levy $10 to $30 for every $100 borrowed. The annual return on a $15 fee is almost 400 percent. Payday loans are available to people with bad credit and do not usually require a credit check. Payday loans are used by around 12 million Americans each year, most of whom do not have access to a credit card or a savings account.

When these loans are not paid off due, many borrowers find themselves in financial problems. More fees are added to the loan each time the borrower extends it. According to the Consumer Financial Protection Bureau, payday lenders levy $10 to $30 for every $100 borrowed. The annual return on a $15 fee is almost 400 percent. Payday loans are available to people with bad credit and do not usually require a credit check. Payday loans are used by around 12 million Americans each year, most of whom do not have access to a credit card or a savings account. Even though most states have laws governing payday loan amounts, the amount that qualifies for a loan varies depending on the borrower’s income and the payday lender. Several states even prohibit borrowers from having multiple outstanding payday loans to discourage people from borrowing large sums of money at high-interest rates. Loan amounts might range from $70 to $1,500, depending on state law.

Even though most states have laws governing payday loan amounts, the amount that qualifies for a loan varies depending on the borrower’s income and the payday lender. Several states even prohibit borrowers from having multiple outstanding payday loans to discourage people from borrowing large sums of money at high-interest rates. Loan amounts might range from $70 to $1,500, depending on state law.

Whether you have a bad credit score because of some faults on your part or having no credit at all, your loan can be approved. This makes online payday loans the only possible way for some people to get the money they need for emergencies and other expenses that popped up and were not included in their budget.

Whether you have a bad credit score because of some faults on your part or having no credit at all, your loan can be approved. This makes online payday loans the only possible way for some people to get the money they need for emergencies and other expenses that popped up and were not included in their budget.

Maybe you are planning on going for a trip to a holiday destination, and everything gets in place. However, you need to sort out the numerous expenses. Fortunately, with online loans, you can now access personal loans without a lot of paperwork. Also, you do not have to make trips to the bank. Thus, with a quick money loan, you can plan a trip to the destination of your choice. It does not matter whether it is a local popular tourist destination or a foreign trip; you can meet your expenses.

Maybe you are planning on going for a trip to a holiday destination, and everything gets in place. However, you need to sort out the numerous expenses. Fortunately, with online loans, you can now access personal loans without a lot of paperwork. Also, you do not have to make trips to the bank. Thus, with a quick money loan, you can plan a trip to the destination of your choice. It does not matter whether it is a local popular tourist destination or a foreign trip; you can meet your expenses.

Once you have completed your financial management course, many new doors will open for you in your company and other companies. The more you study, the more abilities you can have. The more qualified you are, the more likely the company will begin to appreciate what you bring to the table and how you benefit the company as a whole. Training will make you a treasured member of their finance team.

Once you have completed your financial management course, many new doors will open for you in your company and other companies. The more you study, the more abilities you can have. The more qualified you are, the more likely the company will begin to appreciate what you bring to the table and how you benefit the company as a whole. Training will make you a treasured member of their finance team. This course is also responsible for the effective management of the company’s money. Money is necessary for various functions of the company, such as paying salaries and bills, maintaining inventories, fulfilling obligations, and even purchasing materials or equipment. The finance officer has to design, coordinate, and boost capital and monitor and examine its finances in all aspects. This can be done with financial tools such as forecasting, rate analysis, risk and contingency management, and profit and price management.

This course is also responsible for the effective management of the company’s money. Money is necessary for various functions of the company, such as paying salaries and bills, maintaining inventories, fulfilling obligations, and even purchasing materials or equipment. The finance officer has to design, coordinate, and boost capital and monitor and examine its finances in all aspects. This can be done with financial tools such as forecasting, rate analysis, risk and contingency management, and profit and price management.

Some mixing services might need registration before using their services. However, it is risky to create an account, since the service will capture some of the personal details which will make you feel insecure in the end.

Some mixing services might need registration before using their services. However, it is risky to create an account, since the service will capture some of the personal details which will make you feel insecure in the end. Before selecting a tumbling service, it is important to read the reviews. You will be able to know what clients are commenting about the mixing service so that you can make informed choices. Positive reviews are an indication of trustworthiness, hence it should be a priority before mixing coins.

Before selecting a tumbling service, it is important to read the reviews. You will be able to know what clients are commenting about the mixing service so that you can make informed choices. Positive reviews are an indication of trustworthiness, hence it should be a priority before mixing coins.

The greatest advice I can give anyone is to borrow responsibly. You need to know how to borrow without getting deep into debt. Before you get a loan, understand the terms of payment. There are different types of loans, depending on how you want to use the money. Apart from normal loans, we also have a line of credit that can be used for making small purchases. Instant Line of Credit will help you to borrow within your credit limit.

The greatest advice I can give anyone is to borrow responsibly. You need to know how to borrow without getting deep into debt. Before you get a loan, understand the terms of payment. There are different types of loans, depending on how you want to use the money. Apart from normal loans, we also have a line of credit that can be used for making small purchases. Instant Line of Credit will help you to borrow within your credit limit.

Most of the taxpayers who are employees are eligible to deduct their work-related expenses. However, the IRS places various limitations on the amount that they deduct. Therefore, if you are working as an independent contractor, you have an opportunity to deduct all of your business expenses directly from your earnings. Note that your deductions will include different fees, including your car and the cost of supplies.

Most of the taxpayers who are employees are eligible to deduct their work-related expenses. However, the IRS places various limitations on the amount that they deduct. Therefore, if you are working as an independent contractor, you have an opportunity to deduct all of your business expenses directly from your earnings. Note that your deductions will include different fees, including your car and the cost of supplies.

You can tell the financial performance of your business within a specific period when you hire one. Planning for your upcoming business calendar will be easy as a result. An accountant can also help in filing your tax returns and ensuring your business records are up to date. This reduces the chances of landing in trouble with the relevant authorities in your area. Hiring this expert minimizes your work burden because they will carry out some of these tasks for you. There are several things you need to factor in when hiring an accountant for your business. They include:

You can tell the financial performance of your business within a specific period when you hire one. Planning for your upcoming business calendar will be easy as a result. An accountant can also help in filing your tax returns and ensuring your business records are up to date. This reduces the chances of landing in trouble with the relevant authorities in your area. Hiring this expert minimizes your work burden because they will carry out some of these tasks for you. There are several things you need to factor in when hiring an accountant for your business. They include: The amount a specific accountant is charging for their service is the other thing you need to consider when looking for one. You can hire them on a contractual or permanent basis. Discuss the rates to settle on an amount you can pay them.

The amount a specific accountant is charging for their service is the other thing you need to consider when looking for one. You can hire them on a contractual or permanent basis. Discuss the rates to settle on an amount you can pay them.

A country that has a lower inflation rate exhibits rising currency value because its purchasing power increases relative to other currencies. Some of the countries with low inflation include Canada, USA, Germany, Switzerland, and Japan. Countries that have high inflation see depreciation in their currency. That is also accompanied by high interest rates.

A country that has a lower inflation rate exhibits rising currency value because its purchasing power increases relative to other currencies. Some of the countries with low inflation include Canada, USA, Germany, Switzerland, and Japan. Countries that have high inflation see depreciation in their currency. That is also accompanied by high interest rates.

have a smooth time during the loan application and approval process. One of the things they usually look out for is your credit score. If you have low rankings, then the chances of qualifying for one are very minimal. Make sure you follow all the right procedures to improve your credit score.

have a smooth time during the loan application and approval process. One of the things they usually look out for is your credit score. If you have low rankings, then the chances of qualifying for one are very minimal. Make sure you follow all the right procedures to improve your credit score. lenders will look at the available assets when applying for this type of loan. Make sure you have all the assets that may be required by lenders to qualify for this type of loan. Putting all this into consideration keeps you at a good place for qualifying for a loan or getting fast approvals.

lenders will look at the available assets when applying for this type of loan. Make sure you have all the assets that may be required by lenders to qualify for this type of loan. Putting all this into consideration keeps you at a good place for qualifying for a loan or getting fast approvals.

There is a penalty for not paying your taxes. This can be about 1 percent per month of the total amount of tax debt. Also, IRS can charge you interest on the amount you owe them. If you fail to pay your taxes by the set deadline, you have options such as filing for an extension. In this case, you need to fill out the relevant form before the deadline which is usually set on April 15.

There is a penalty for not paying your taxes. This can be about 1 percent per month of the total amount of tax debt. Also, IRS can charge you interest on the amount you owe them. If you fail to pay your taxes by the set deadline, you have options such as filing for an extension. In this case, you need to fill out the relevant form before the deadline which is usually set on April 15. It is unfortunate that most people forget to sign everything on their tax returns. When you sign your tax return, it means that you are declaring under the law that the information you have provided is accurate and true. You cannot cross out perjury statement and if you do, it will invoke a civil penalty. Moreover, your tax return cannot be accepted for processing. Other than the signature, the date of return must be the day you signed it. Also, telling the IRS your telephone number and occupation is optional.

It is unfortunate that most people forget to sign everything on their tax returns. When you sign your tax return, it means that you are declaring under the law that the information you have provided is accurate and true. You cannot cross out perjury statement and if you do, it will invoke a civil penalty. Moreover, your tax return cannot be accepted for processing. Other than the signature, the date of return must be the day you signed it. Also, telling the IRS your telephone number and occupation is optional.

Why do you want to invest in the stock market? Do you need your cash back? Do you want to save for retirement, buy a home, build an estate, or cater for future expenses? Before you start to invest, there is a need to know the purpose and the time in the future you want funds. If you want an investment that will generate profits in the coming few years, you should consider another investment. Remember that the stock market can be volatile and it does not provide any certainty that all your capital is available whenever you need it.

Why do you want to invest in the stock market? Do you need your cash back? Do you want to save for retirement, buy a home, build an estate, or cater for future expenses? Before you start to invest, there is a need to know the purpose and the time in the future you want funds. If you want an investment that will generate profits in the coming few years, you should consider another investment. Remember that the stock market can be volatile and it does not provide any certainty that all your capital is available whenever you need it. Failing to control your emotions and make logical decisions can be a huge obstacle towards your trading on the stock market. Remember that in the short-term, the prices reflect combined emotions of the investment community. For instance, if a lot of investors are worried about a given company, its stock price is likely to decline. When stock prices move control to your expectations create insecurity and tension. Before you purchase stock, you should have a good reason for doing so.

Failing to control your emotions and make logical decisions can be a huge obstacle towards your trading on the stock market. Remember that in the short-term, the prices reflect combined emotions of the investment community. For instance, if a lot of investors are worried about a given company, its stock price is likely to decline. When stock prices move control to your expectations create insecurity and tension. Before you purchase stock, you should have a good reason for doing so.

This can be defined as a short-term loan that is free to allow you to access your tax refund sooner. Ideally, the amount of money you get is based on the expected tax refund. You need to file your taxes by the same tax-prep company ahead of the refund deadline. Usually, you may get the money the same day or wait for 24 hours. However, some tax returns take quite long to review, and the money is sent within three weeks.

This can be defined as a short-term loan that is free to allow you to access your tax refund sooner. Ideally, the amount of money you get is based on the expected tax refund. You need to file your taxes by the same tax-prep company ahead of the refund deadline. Usually, you may get the money the same day or wait for 24 hours. However, some tax returns take quite long to review, and the money is sent within three weeks. Most tax preparation companies will provide you with a tax loan without fees or interest. However, they are likely to charge the preparation feels to process the loan or file your taxes. Thus, such costs will reduce your expected tax refunds. There is free tax software that can help you file taxes online. Moreover, your tax refund loan is likely to be issued on a debit card. Thus, the card may have its associated fees. Sometimes you may get a higher loan than the tax refund because of a miscalculation by the tax preparation company.

Most tax preparation companies will provide you with a tax loan without fees or interest. However, they are likely to charge the preparation feels to process the loan or file your taxes. Thus, such costs will reduce your expected tax refunds. There is free tax software that can help you file taxes online. Moreover, your tax refund loan is likely to be issued on a debit card. Thus, the card may have its associated fees. Sometimes you may get a higher loan than the tax refund because of a miscalculation by the tax preparation company.

have had the chance of enrolling in such schools will help you settle for the best. You can also look at the approval ratings of the different day trading schools. There are a myriad reasons why you should sign up for an online day trading academy. They include:

have had the chance of enrolling in such schools will help you settle for the best. You can also look at the approval ratings of the different day trading schools. There are a myriad reasons why you should sign up for an online day trading academy. They include:

Spread refers to the transaction cost. Currencies, unlike stocks, are not traded through a central exchange. Therefore different brokers will quote different spreads. This is a major consideration in every trader’s mind since choosing brokers with very high spreads is a way to kill off your account.

Spread refers to the transaction cost. Currencies, unlike stocks, are not traded through a central exchange. Therefore different brokers will quote different spreads. This is a major consideration in every trader’s mind since choosing brokers with very high spreads is a way to kill off your account.

There are many reasons you might find yourself in some financial mess. It could be some wrong choices that could have landed you in some financial mess or wage garnishment. These circumstances can be quite challenging to deal with in the short term. Here are situations that require urgent cash and could be remedied by bad credit loans.

There are many reasons you might find yourself in some financial mess. It could be some wrong choices that could have landed you in some financial mess or wage garnishment. These circumstances can be quite challenging to deal with in the short term. Here are situations that require urgent cash and could be remedied by bad credit loans.

The first thing to do is filing the returns on time to ensure your file with the revenue authority is in order and to lower chances of paying penalties. Keeping your tax return profile in check is important. The nature of your financial statements affects the type of tax returns to fill, and individuals may not have many complications since you only need to declare incomes and highlight what employers are remitting. Much of the information will be available on your system’s profile. However, those seeking refunds usually have additional details to offer to declare expenses and other conditions for a refund. Starting the process early eases your prospects of qualifying for refunds with the present financial year.

The first thing to do is filing the returns on time to ensure your file with the revenue authority is in order and to lower chances of paying penalties. Keeping your tax return profile in check is important. The nature of your financial statements affects the type of tax returns to fill, and individuals may not have many complications since you only need to declare incomes and highlight what employers are remitting. Much of the information will be available on your system’s profile. However, those seeking refunds usually have additional details to offer to declare expenses and other conditions for a refund. Starting the process early eases your prospects of qualifying for refunds with the present financial year.

One of the best ways of achieving financial independence is having an extra source of livelihood to sustain the main one. If for instance you are employed, you may want to consider investing in some other business, no matter how small it is to supplement your income. By so doing, you will ensure that you always have an extra coin that you can spend instead of taking a loan. You may also use the business to settle your other financial obligations.

One of the best ways of achieving financial independence is having an extra source of livelihood to sustain the main one. If for instance you are employed, you may want to consider investing in some other business, no matter how small it is to supplement your income. By so doing, you will ensure that you always have an extra coin that you can spend instead of taking a loan. You may also use the business to settle your other financial obligations.

It is always advisable that in investment, no to have all your eggs in one basket. It is always recommended that one gets several income streams to support them preferably in different lines of business. The reason behind this is that sometimes, a force beyond your control may affect the industry where you have invested your money. If the industry goes down, chances are that you will too.

It is always advisable that in investment, no to have all your eggs in one basket. It is always recommended that one gets several income streams to support them preferably in different lines of business. The reason behind this is that sometimes, a force beyond your control may affect the industry where you have invested your money. If the industry goes down, chances are that you will too.